Ahead of the curve, mapping logistics REITs in stagnating trade environment

As world trade is expected to continue to lose momentum into 2023 and remain subdued at least for the next year, it is likely to result in higher degree of divergent performance of REITs in the sector. Investors will need to look deeper into local market dynamics to ascertain company specific prospects over the next phase of the cycle and stay ahead of the curve.

The WTO currently predicts a nominal 1.0% increase in trade volumes for 2023, down sharply from the previous estimate of 3.4% as multiple shocks weigh on the global economy while in the US import volumes of goods fell by -2.3% in Q3 compared to previous quarter (still up by ca 7% yoy). In this note, we evaluate which logistics REIT companies are likely to perform better than peers in the next phase of the cycle based on local market dynamics, freight volumes and asset geolocations.

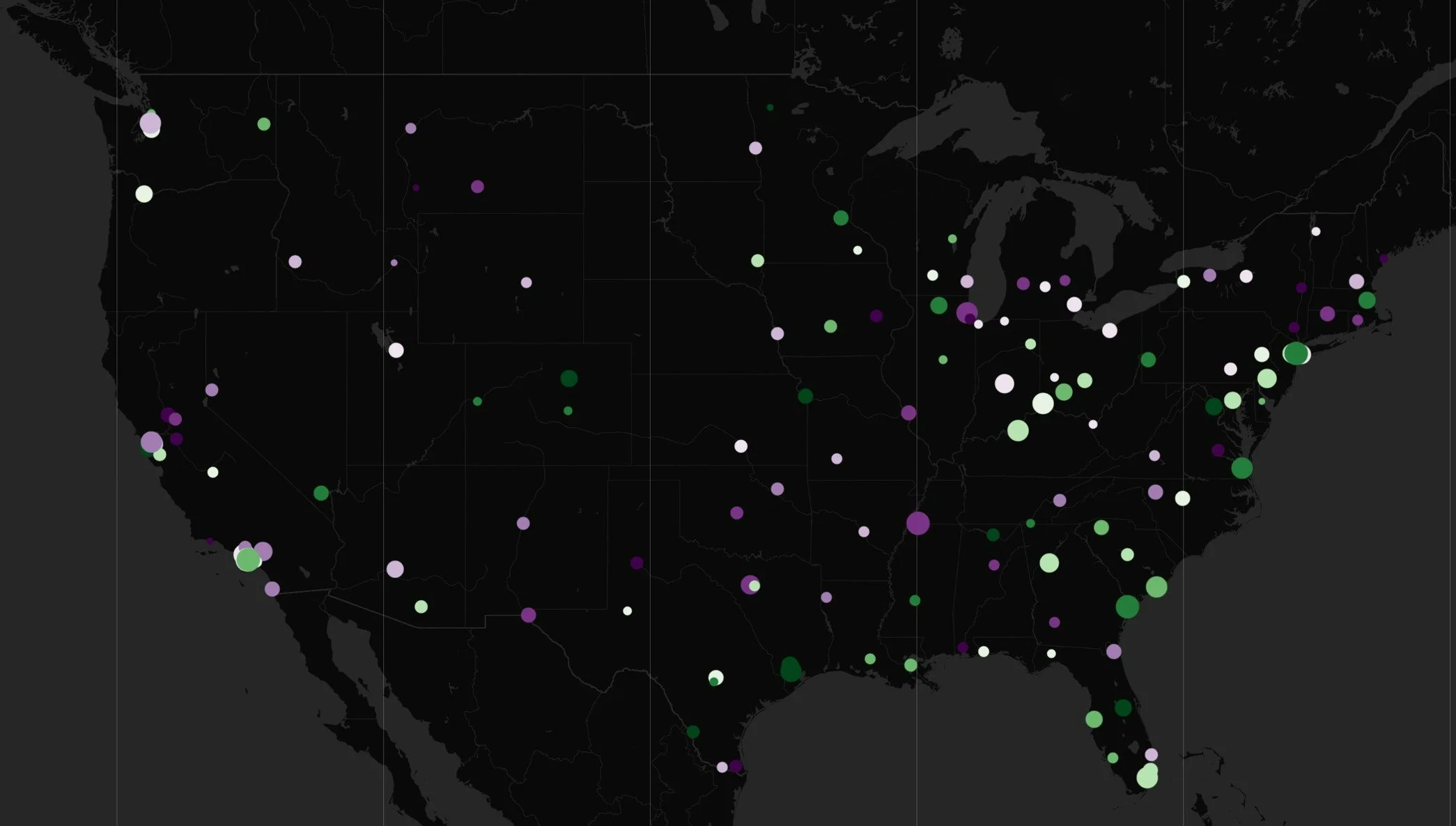

We evaluate freight volumes across approximately 600 US freight handling locations including ports and airports, some 150 of those are shown in Fig 1, green areas show locations where freight volumes have risen year-to-date compared to the same period last year and darker purple areas indicate falling volumes. There is a large variation across US locations ranging as significantly as +25% to -25%, with a number of locations experiencing sharp declines compared to longer-term trends.

Naturally, most logistics REITs assets are in close proximity to freight handing locations as shown in Fig 2, in total ca 4,300 US logistics assets with a capacity of nearly 900M sq ft are analysed.

We create demand indicators for each logistics REIT by assigning changes in freight volumes at each freight handling location to individual assets of that REIT within different radius ranges, an example is illustrated in Fig 3. In a final step we calculate the aggregate impact on demand for each REIT weighted by sq ft of each asset within the company’s overall portfolio.

Fig 1. Main freight handling locations across the US

Fig 2. Logistics REITs’ asset locations naturally overlay freight handing locations

Fig 3. Example of freight handling location and radius of logistics REITs’ asset locations

Source: Kania Advisors

Report and inquiries

Contact Kania Advisors by email info@kaniaadvisors.com

to request a copy of the full report

to request data from this report

to request data for other regions

About Kania Advisors

Kania Advisors is an independent research and advisory firm focused exclusively on institutional real assets allocations and investment programmes. We provide advice and solutions to improve outcomes in real assets investment programmes. We conduct detailed industry research and custom studies typically focused on quantitative analysis and provide insights which form a critical part of a client's decision process.